Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method

Sample Video

- Last Updated: 05-25-2024

- Duration: 5.83 hour(s), 3 video(s)

- Size: 3.5 GB

$29

Buy More, Save More!

2 Courses

10% OFF

3 Courses

15% OFF

5 Courses

30% OFF

Why Choose TSCourses?

- Learn online or download via Google Drive

- All course files are included

- Free course updates via email

- Seen it cheaper? We'll beat the price

Curriculum (Google Drive Proof)

View ProofTrading the Crypto Market with the Wyckoff Method by Wyckoff Analytics

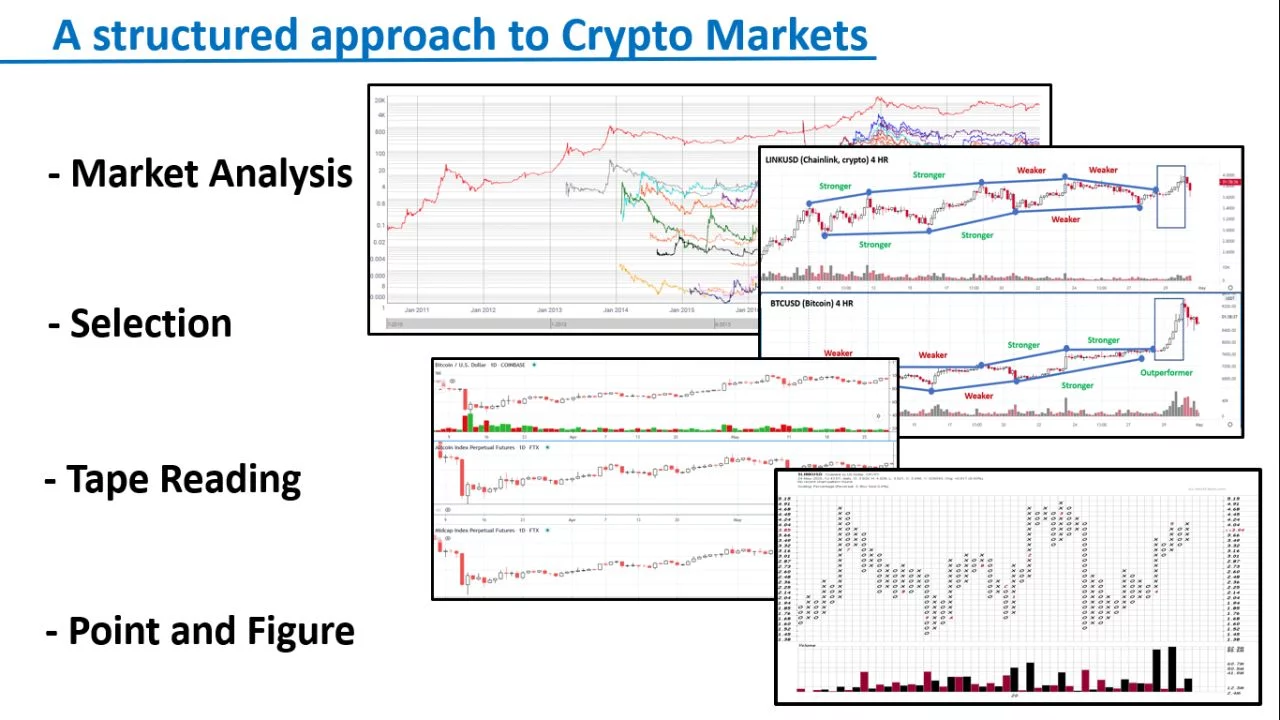

Cryptocurrencies have emerged as one of the most speculative investment options in the past decade. Engaging in investing and trading within the crypto space demands discipline and a systematic approach. Enter the Wyckoff Method, which offers a logical framework suitable for both long-term investors and intraday traders.

In an informative series of three sessions, Alessio Rutigliano will demonstrate how to effectively apply techniques that have been employed by generations of stock and commodities traders to this new and dynamic asset class. The course is designed to cater to a variety of traders, from those seeking long-term investment opportunities through traditional ETNs to advanced crypto traders aiming to capitalize on the high volatility and momentum inherent in these instruments. Throughout the course, participants will delve into case studies from both Bitcoin and Altcoin markets and engage in practical exercises.

Key topics covered in the three sessions include:

The Wyckoff Method: Transitioning from stocks to cryptos and learning to interpret the actions of the Composite Operator. Analysis of cyclical accumulations in Microsoft, Gold, and Bitcoin.

Understanding the Anatomy of the Crypto Market: Exploring 10 years of market history through price and volume analysis, with a focus on cyclical accumulations and the role of news cycles in crypto markets.

Tape Reading and Market Participant Analysis in Low Liquidity Environments: Assessing how liquidity influences market structure, and examining price and volume nuances specific to cryptocurrencies and mid-low cap assets.

Relative Strength Analysis: Similar to equity funds, crypto funds prioritize relative performance. Learn how to identify leadership traits among assets and leverage comparative analysis to enhance performance.

Timing Strategies: Understanding the rhythm of speculative markets characterized by periods of stagnation followed by aggressive upward movements. Learn to recognize pivotal moments that can shape market outcomes.

Point and Figure Charting in Crypto Markets: Adapting one of the oldest forms of technical analysis to modern high-tech financial instruments.

Campaigning Crypto Assets: Strategies tailored for long-term investors and stock traders, including Bitcoin ETNs, Grayscale Investment Trusts, and Blockchain and Mining Stocks.

The Altcoin Swing Trader: Developing a trading plan for high momentum cryptos and exploring strategies for mid and micro-cap crypto assets.

The Intraday Trader: Exploring trading opportunities in Bitcoin Perpetual Contracts and Crypto Indexes.

Join us as we delve into the intricacies of trading the crypto market using the time-tested principles of the Wyckoff Method. Gain insights and strategies that can help navigate the complexities of this rapidly evolving asset class.

More courses you might like

Black Rabbit Trader – Smart Money Scalps

How I Scalped The Nasty NAS and Dirty 30 Every Day & Made $2k,$3k Even...

RC Visionaries – The RCV Course

RC Visionaries - The RCV Course The RCV course will consist of over 40 videos...

Anton Kreil – Professional Trading Masterclass

Anton Kreil - Professional Trading Masterclass Welcome to the most comprehensive online Trading Education Courses...

100K Dollars Club – Psychology of Successful Trader

Are you able to unlock the secrets and techniques of profitable merchants and take your...