Highstrike Trading School

- Last Updated: 06-01-2021

- Size: 12.76 GB

$49

Buy More, Save More!

2 Courses

10% OFF

3 Courses

15% OFF

5 Courses

30% OFF

Why Choose TSCourses?

- Learn online or download via Google Drive

- All course files are included

- Free course updates via email

- Seen it cheaper? We'll beat the price

Curriculum (Google Drive Proof)

View ProofHighstrike Trading School

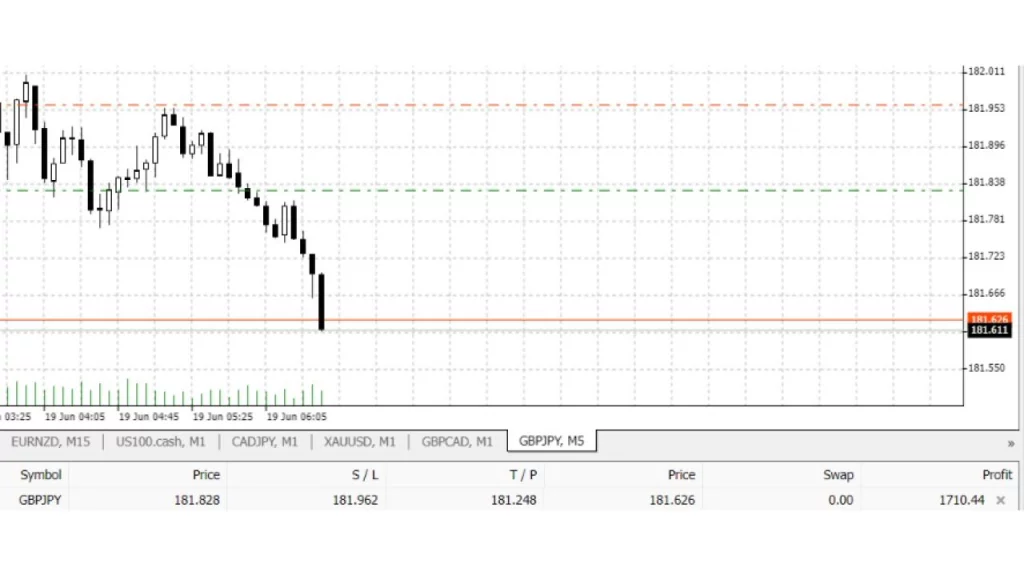

HighStrike Trading has educated thousands of students and represents one of the largest communities of both professional and hobby traders in the world. We have developed a world-class trading education platform used by thousands of traders across more than 150 countries, serviced by three dedicated and skilled instructors.

HST School students get lifetime access to our massive video lesson library including 100+ training videos. They are also added to our student group chat which contains invaluable market insights, new daily market briefing videos, and the ability to communicate ideas and ask questions with thousands of other traders and instructors in real time.

Highstrike Trading School Cheap

Highstrike Trading School Course

Highstrike Trading School Download

More courses you might like

The Inner Circle Dragons Trading Academy – Ali Khan

SAVE TIME & LEARN ICT/SMC CONCEPTS IN STRUCTURED, BITESIZE 10 MIN VIDEOS – ALL IN...

1 Minute Master – The Holy Grail Forex Strategy – 7 Setups To Conquer The Kingdom

1 Minute Master – The Holy (*7*) Forex Strategy – 7 Setups To Conquer The...

TraderLion – Trading Psychology Masterclass – Jared Tendler

You have got the technical abilities however you… maintain making the identical errors Hesitating on...

Fx Carlos – FXC Trading The Holy Grail

Introducing the Fx Carlos – FXC Trading The Holy Grail course, a complete foreign currency...